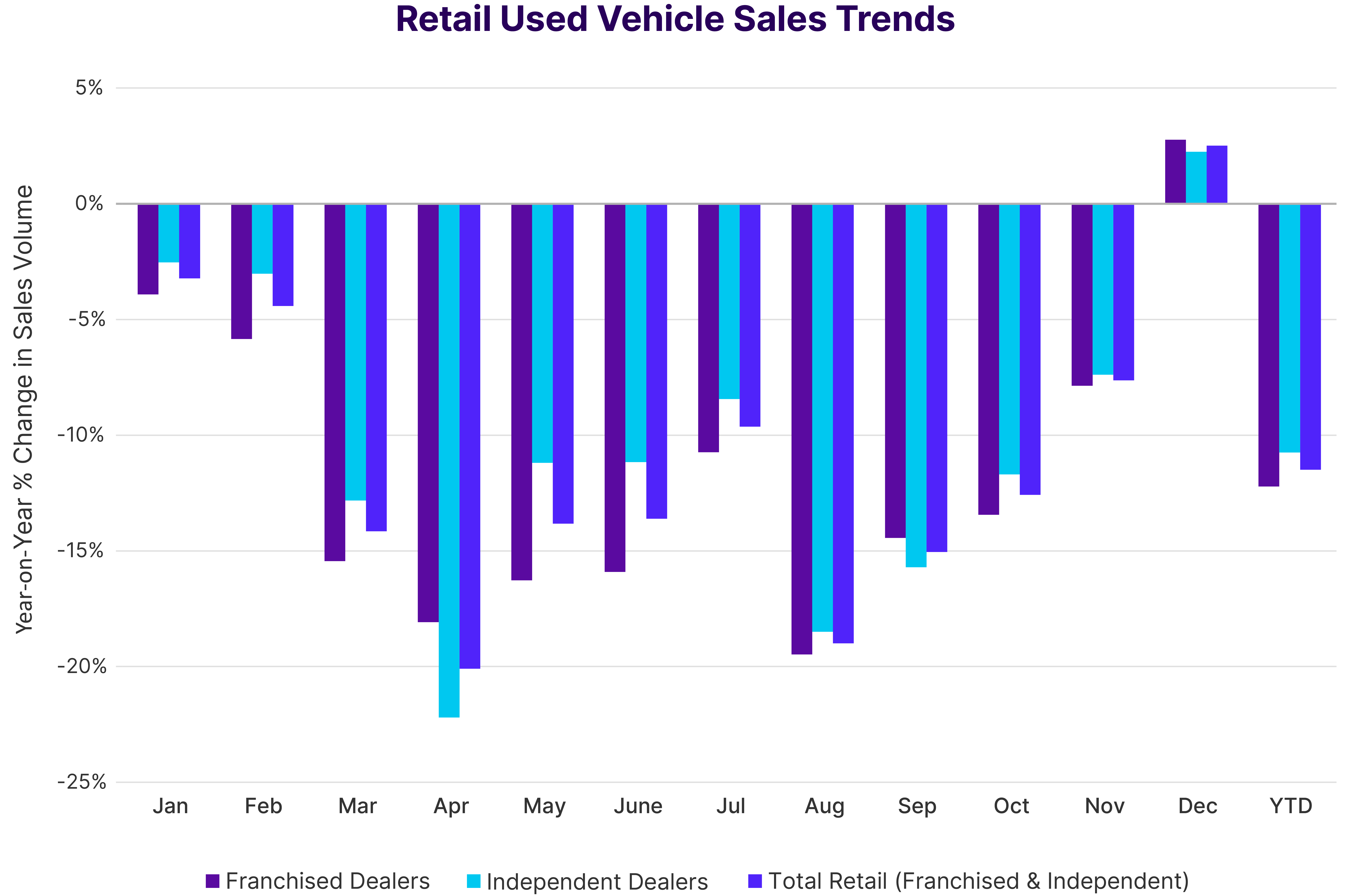

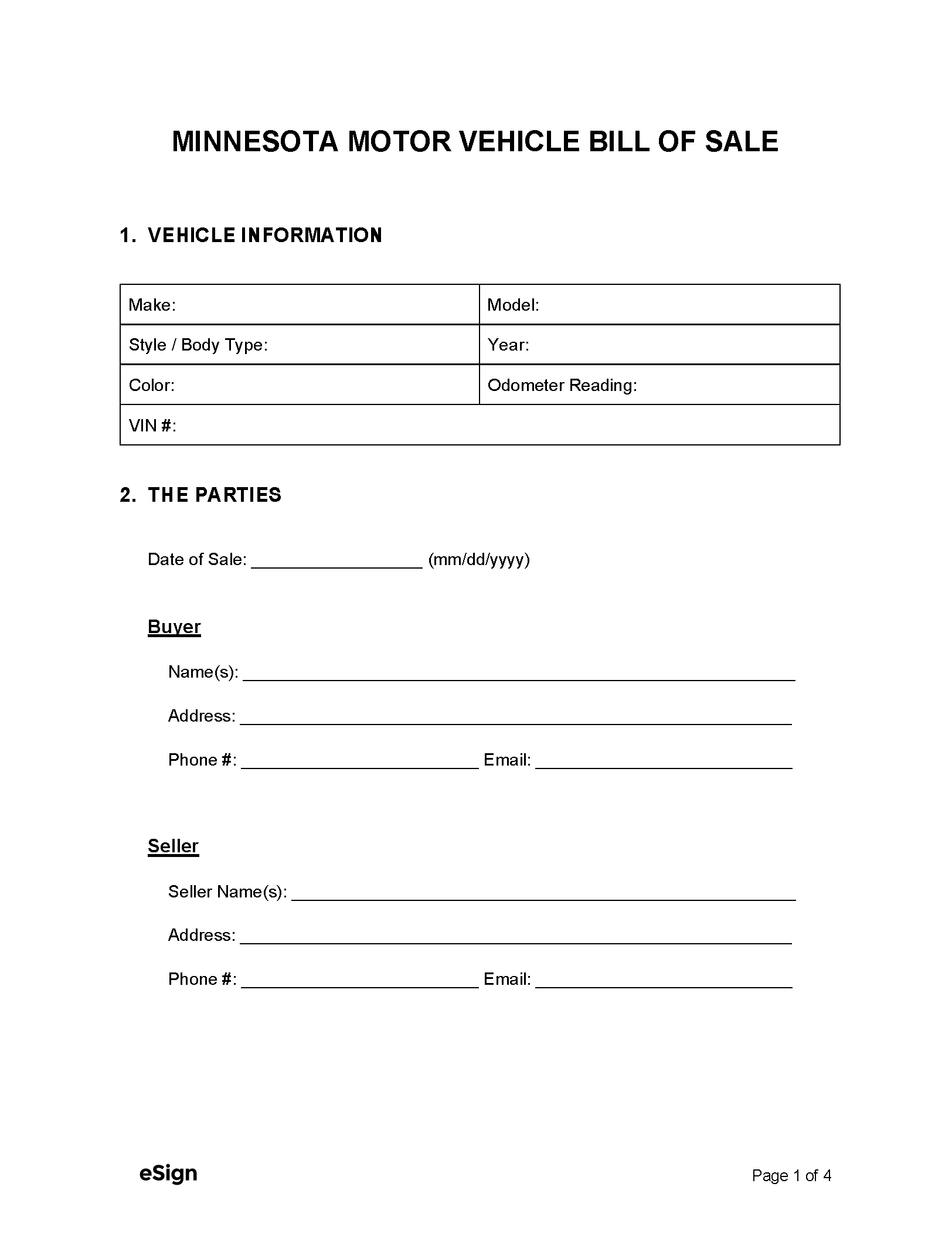

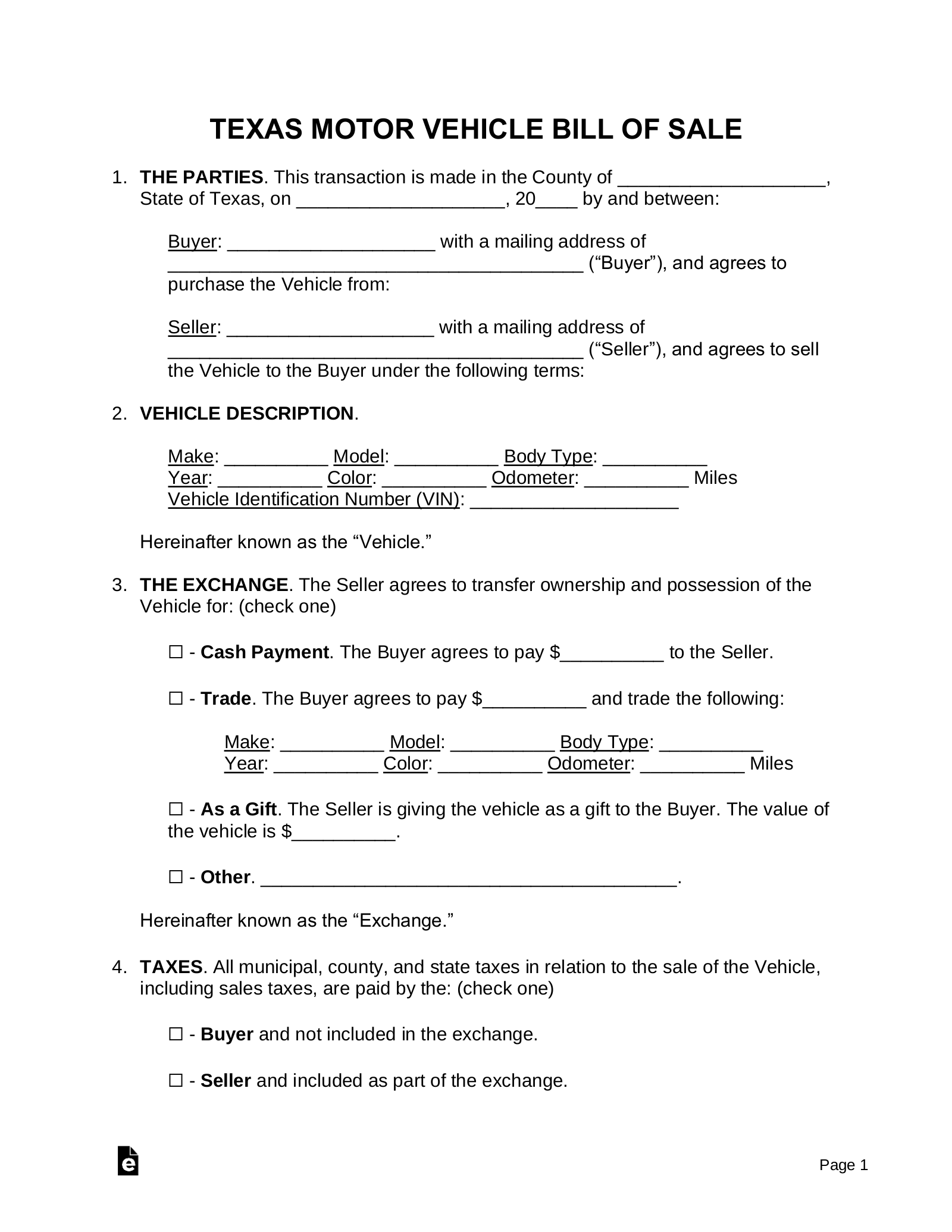

Webtexans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of 6. 25 percent on the purchase price or. Webtexas has a 6. 25% statewide sales tax rate, but also has 959 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales. Webdec 9, 2022 · if buying from an individual, a motor vehicle sales tax (6. 25 percent) on either the purchase price or standard presumptive value (whichever is the highest value), must. Webjan 12, 2023 · tax, title, and license fee on a new car in texas that costs $25,000 would be around $1,700. Sales tax, title transfer fee, vehicle inspection,. Webmotor vehicle sales tax is due on each retail sale of a motor vehicle in texas. A motor vehicle sale includes installment and credit sales and exchanges for property, services.

Vehicle Sales Tax Texas

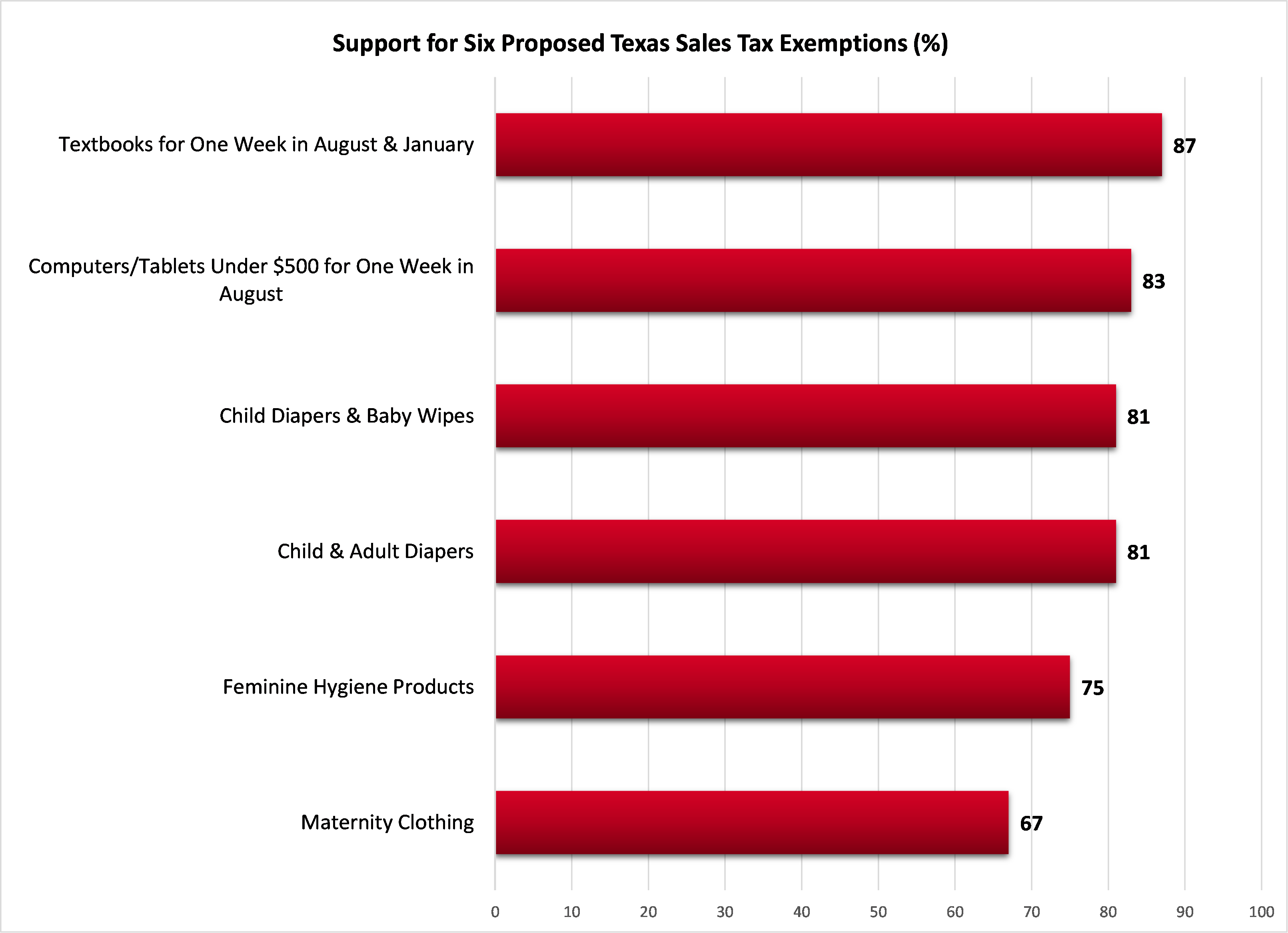

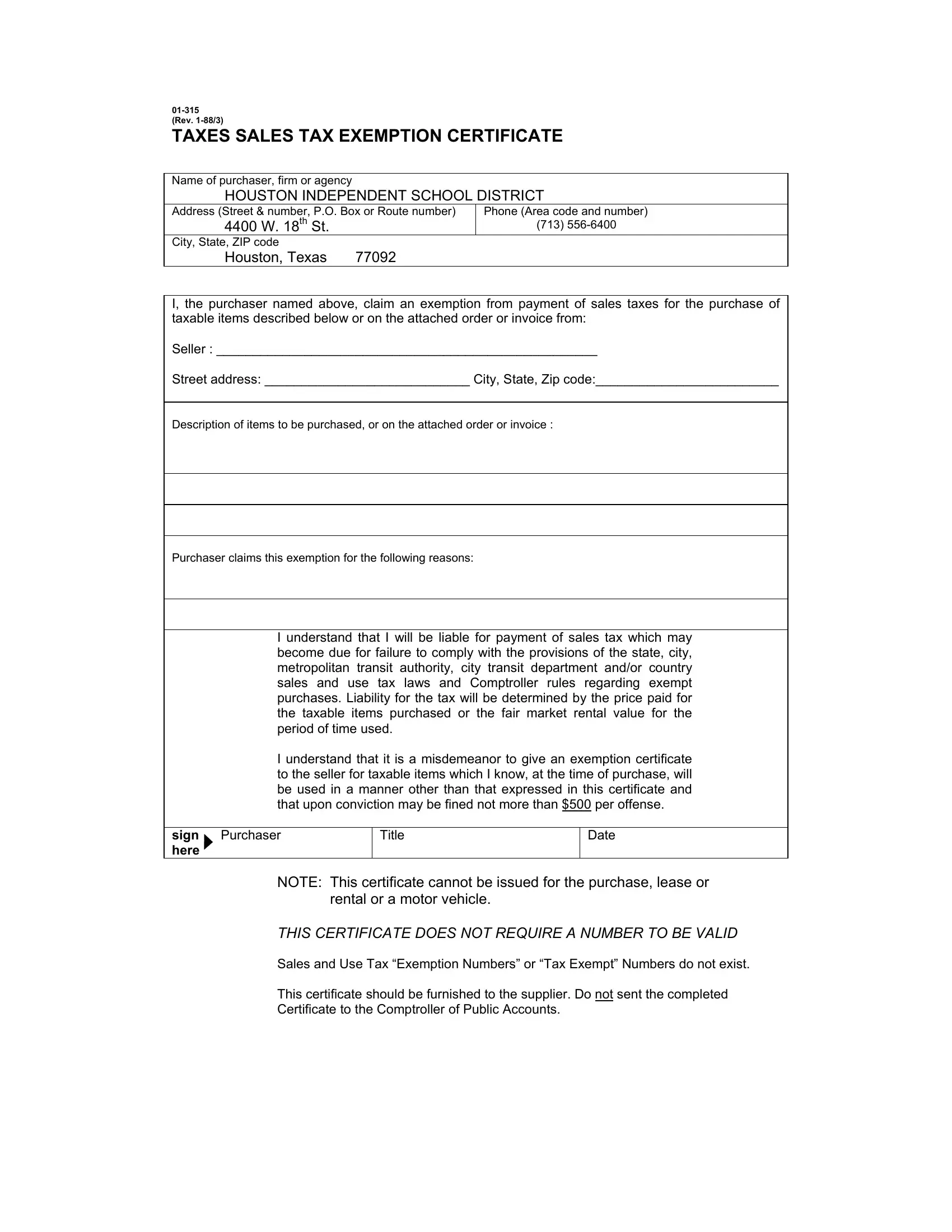

Texas Sales TaxExempt

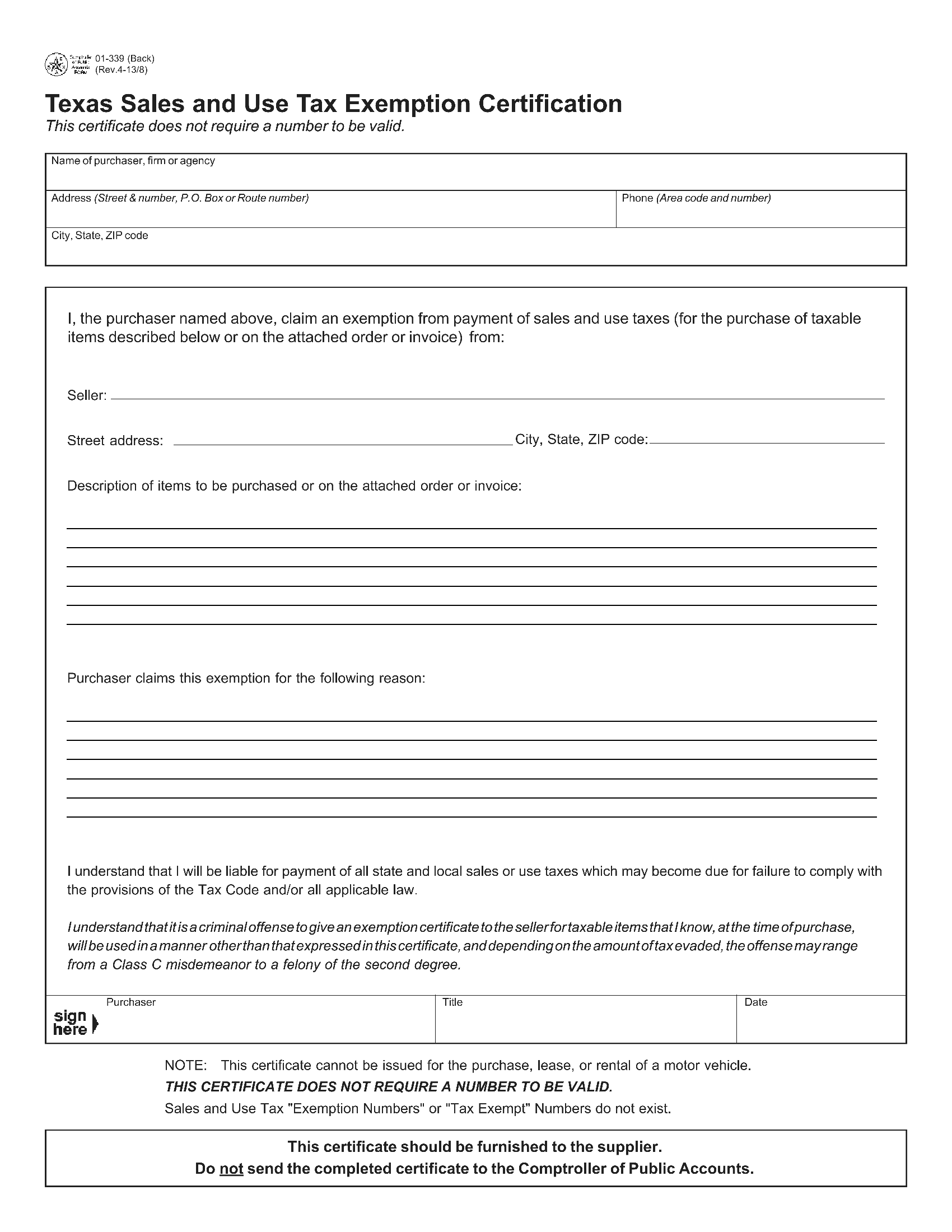

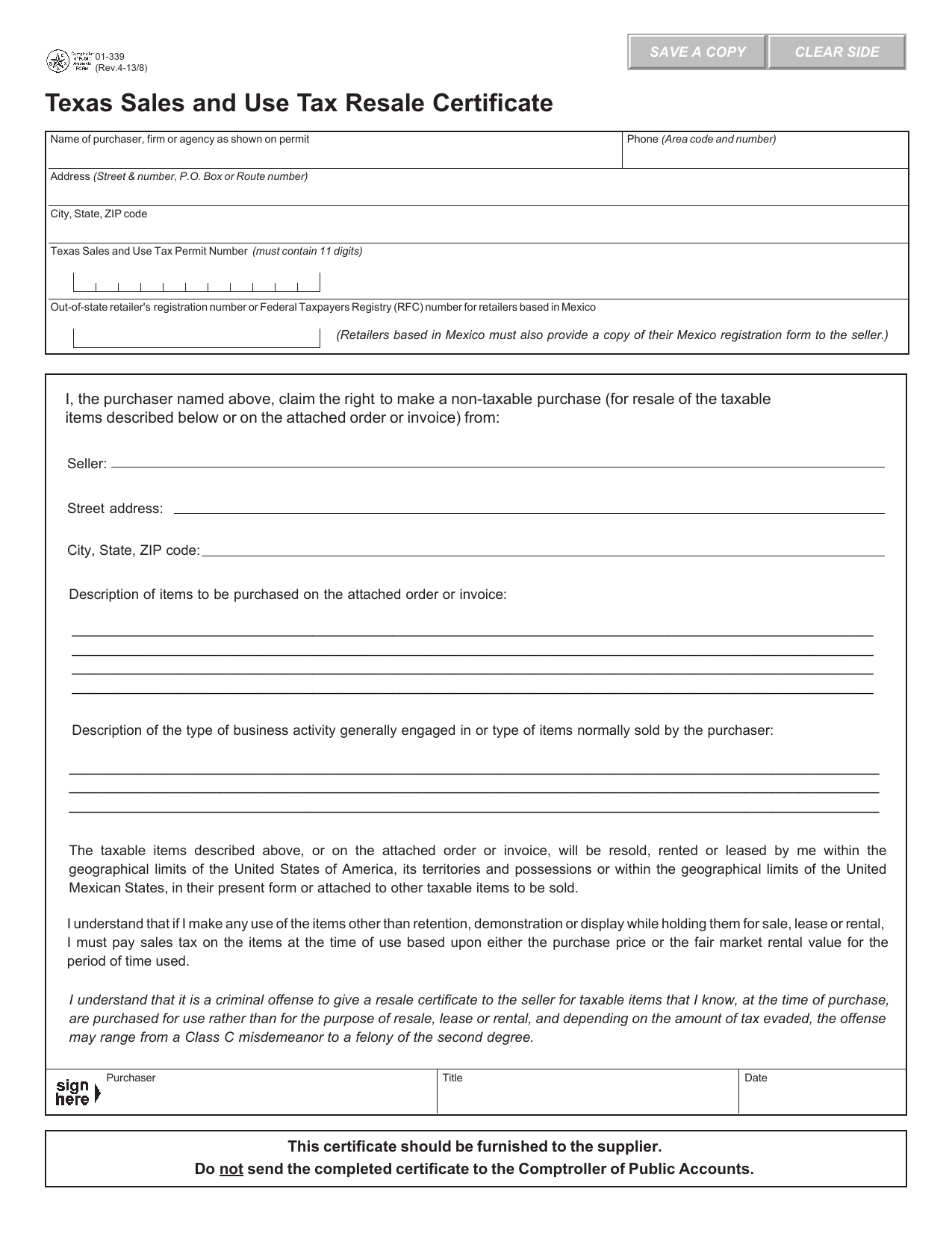

Texas State Sales TaxForm

Texas Salesand Use Tax

Texas Sales TaxExemption Form

Texas Salesand Use Tax Permit

Texas Sales TaxCertificate

Texas Sales TaxResale Certificate

Texas Salesand Use Tax Return

Sales TaxMap

Printable Sales TaxForm Texas

Texas Sales TaxRate

Texas Sales TaxChart

TexasState Comptroller Sales Tax