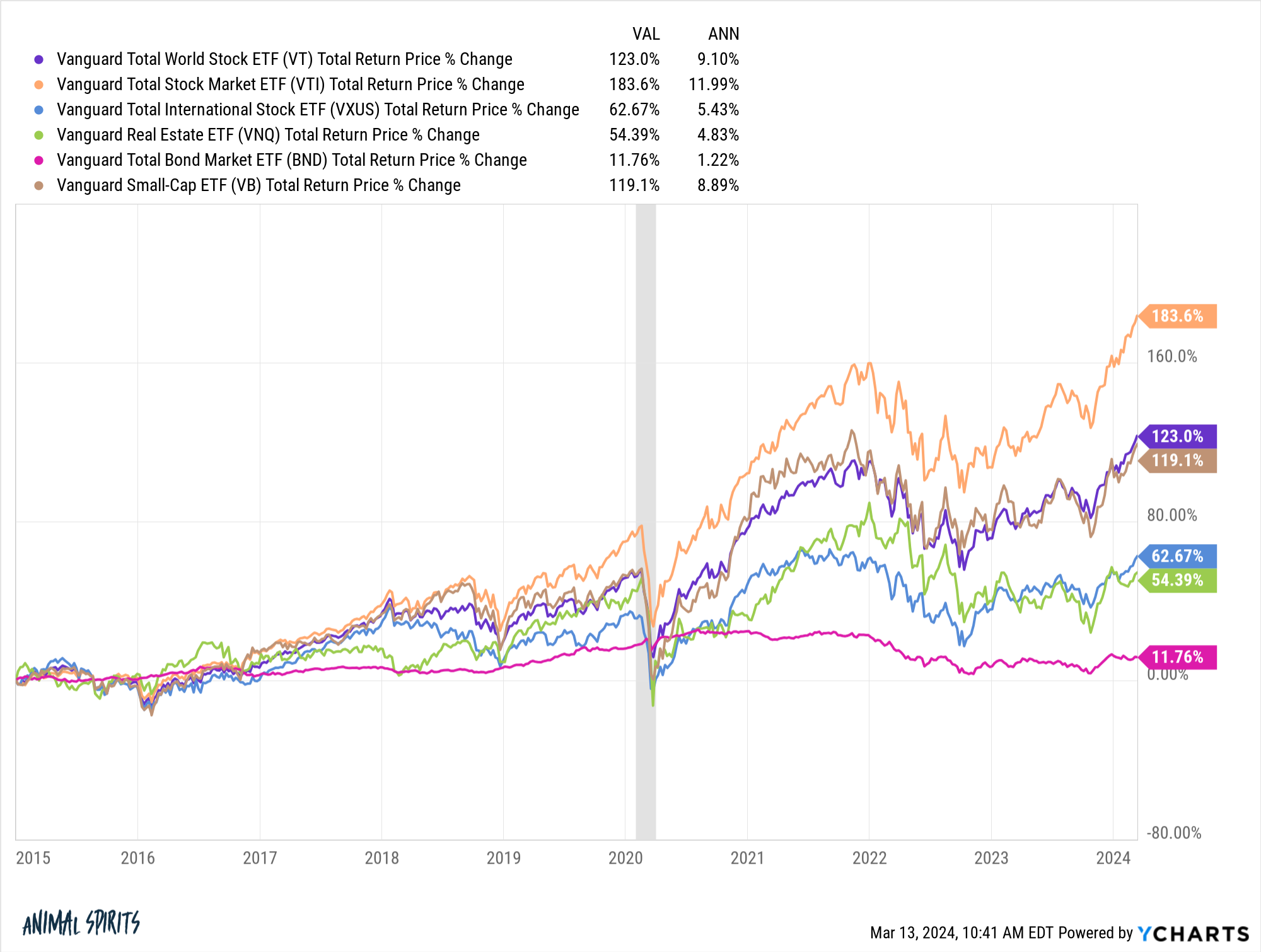

Webthe most ideal thing is to rebalance vti/vxus. If you have 100m nw then it saves you a lot. If you’re Point is there is no wrong. Weboct 4, 2024 · compare and contrast key facts about vanguard total stock market etf (vti) and vanguard total international stock etf (vxus). Vti and vxus are both. It compares fees, performance, dividend yield, holdings, technical indicators, and many other metrics that. Webfrom a financial standpoint, vti + vxus > vt only if you allocate / rebalance properly. While you can do better due to the slightly lower fees, human emotion / error in the. Webassuming a market weight equity portfolio, if you hold vtsax+vxus instead of vt then 40% of your equity would be vxus, so the value of the ftc would be 0. 09% (0. 23 * 40%) or greater than the entire expense ratio. Webcompare vti and vxus etfs on current and historical performance, aum, flows, holdings, costs, esg ratings, and many other metrics.

Recent Post

- Chavez Funeral Home Obituaries

- Foundational Courses Omscs

- Delia Anne Fabro

- Indeed Jobs Casa Grande

- Busted Newspaper Mcpherson Kansas

- Mybig Lots

- Surf Chex Surf City Nc

- Bogleheads Which Vanguard Primecap Fund

- Ck3 Best Ethos

- John Chiv

- Swic Belleville Il

- Payoff Number For Ally Financial

- World History Quizlet

- Arrione Curry

- Blox Fruit Information

Trending Keywords

Recent Search

- Sofia Ojeda Kprc

- Petaluma Argus Courier Obits

- Lexia Level 21

- Worst Neighborhoods In Detroit

- Auto Zone Car Battery

- Christopher Sturniolo Age

- Case Manager Memes

- Ccap Wisconsin Inmate Search

- American Family Care Covid Testing

- Door Dash Driver Application

- Korean Long Hair Style

- Crime Scenes Of Ted Bundy

- Walgreens Home Page

- Frank And Solomon Nixon Funeral Home

- Maddox Funeral Home Obituaries

_14.jpg)